Making Car Ownership a Reality for Every Indian

In a country where over 60% of the population lives in rural and semi-urban areas, car ownership remains a distant dream for many due to limited access to formal vehicle finance. Addressing this gap, Maruti Suzuki India Limited (MSIL) has partnered with ESAF Small Finance Bank to bring affordable and accessible car loans to the masses.

This strategic collaboration aims to transform how people in underbanked areas buy cars, making personal mobility easier than ever. This article explores everything you need to know about the partnership, its benefits, and what it means for India’s auto-financing landscape.

Overview: What the Partnership Entails

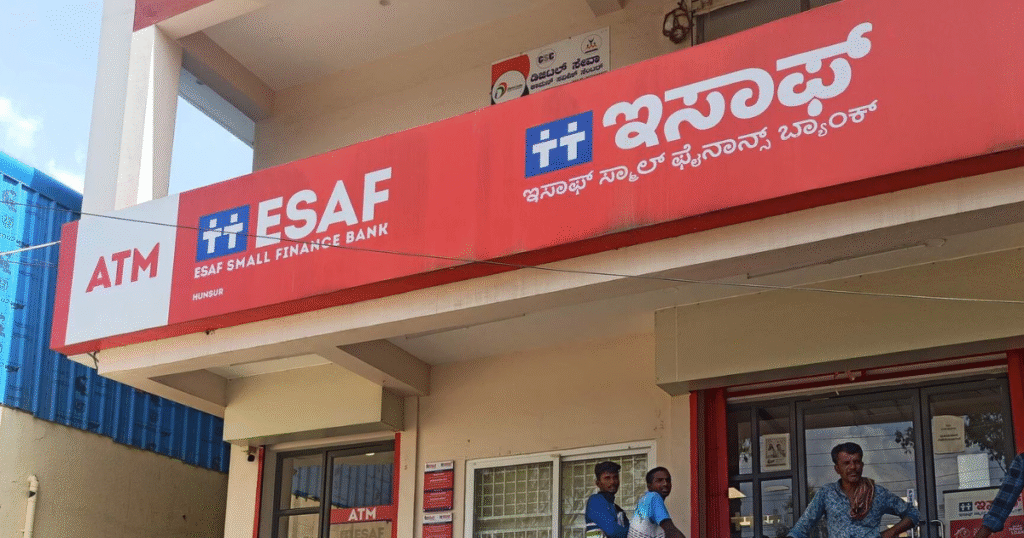

Maruti Suzuki, India’s largest car manufacturer, is known for its wide network and budget-friendly models. ESAF Small Finance Bank is a prominent player in the inclusive finance sector, with deep roots in rural India.

Key Highlights of the Partnership:

- Pan-India rollout across ESAF’s 700+ branches.

- Focus on customers with limited or no credit history.

- Offers affordable EMIs and customized loan solutions.

- Targets customers in Tier 2, Tier 3 cities, and rural belts.

This partnership is designed to help individuals who were previously overlooked by traditional banks and NBFCs.

Why This Matters for Indian Car Buyers

The auto industry in India is witnessing a strong rebound, but financing remains a hurdle, especially outside metro cities.

The Maruti Suzuki–ESAF partnership addresses this by:

- Offering vehicle loans to new-to-credit and informal income customers.

- Promoting financial literacy and vehicle ownership education.

- Supporting women borrowers and micro-entrepreneurs.

With the growing aspiration of owning a car, this initiative fuels a deeper transformation—financial inclusion through mobility.

About ESAF Small Finance Bank

ESAF (Evangelical Social Action Forum) Small Finance Bank started as a microfinance institution focused on empowering the underprivileged. Today, it has evolved into a full-fledged banking institution with:

- 700+ branches across 21 states

- Strong customer base in Kerala, Tamil Nadu, Maharashtra, Odisha

- Programs aimed at women, daily-wage earners, and small businesses

The bank’s mission, “Joy of Banking for All,” aligns seamlessly with Maruti Suzuki’s ethos of “Mobility for All.”

Maruti Suzuki’s Strategic Approach to Vehicle Financing

Maruti Suzuki isn’t new to finance partnerships. With over 30 financing partners, the company has been consistently working to reduce ownership barriers.

This collaboration with ESAF enhances their approach in the following ways:

- Deep rural penetration: Access to remote and tribal regions.

- Digitally assisted financing: Paperless, quick loan approvals.

- Green mobility: Special rates on fuel-efficient and hybrid models.

By combining Maruti’s market leadership with ESAF’s rural trust, the alliance opens new avenues for first-time car buyers.

Empowering Rural India: A Win for Financial Inclusion

India’s rural and semi-urban population often lacks access to banking services, let alone auto loans. This partnership ensures:

- Low-income customers can apply with simplified documentation.

- Flexible repayment plans for seasonal or informal earners.

- Local language support and branch-based application assistance.

In doing so, it bridges the credit access gap and boosts mobility in regions where public transport is unreliable.

Top Benefits for Customers at a Glance

| Feature | Customer Benefit |

|---|---|

| Competitive Interest Rates | Affordable monthly EMIs |

| Minimal Documentation | Faster approvals even for informal workers |

| 700+ Branches of ESAF | Easy local access in small towns |

| Women-Friendly Schemes | Special loans and concessions |

| Digital and Assisted Loan Processing | Time-saving and transparent procedures |

What Industry Leaders Are Saying

“This tie-up will empower the next wave of car buyers from Bharat and unlock tremendous growth in smaller markets.”

— Partho Banerjee, Senior Executive Officer, Sales & Marketing, Maruti Suzuki India

“With our presence in rural India, we are confident this partnership will redefine accessibility to car ownership.”

— K Paul Thomas, MD & CEO, ESAF Small Finance Bank

Frequently Asked Questions (FAQs)

1. Who is eligible for a loan under this scheme?

Anyone interested in purchasing a Maruti Suzuki vehicle—especially those with limited banking history or informal income—can apply.

2. What documentation is required?

Basic KYC documents like Aadhaar, PAN, address proof, income proof (where available), and recent bank statements.

3. Is online application available?

Yes, ESAF and Maruti Suzuki are offering both digital and assisted offline application support.

4. Are there any specific models included?

All models under Maruti Suzuki’s portfolio are eligible, including the Alto, Baleno, Brezza, and the new Fronx.

5. What support is available for first-time women buyers?

ESAF Bank provides women-specific loan offers and dedicated customer support in many branches.

Conclusion: Driving Dreams, Empowering Lives

This partnership is more than just a business agreement—it’s a social impact move. Maruti Suzuki and ESAF Small Finance Bank together are working toward a future where owning a car is not just a privilege for urban dwellers but a right for every hardworking Indian.

By expanding access to easy, transparent, and inclusive vehicle loans, this alliance will unlock opportunities, create jobs, and elevate living standards across India.

💬 Have a question or opinion? Drop a comment below.

🔗 Explore more on NewsNominal.com

📤 Share this article to help someone fulfill their car dream.